Capability Debt: The New Business Risk No One Is Measuring

Most organisations are highly disciplined when it comes to managing financial risk. They monitor cash flow, track liabilities, assess credit exposure, and regularly review balance sheet health. Leaders understand that unmanaged financial debt eventually constrains strategic options and threatens organisational stability.

However, there is another form of debt accumulating quietly inside many organisations. It rarely appears in formal reports, is seldom discussed at board level in a structured way, and is almost never audited in any meaningful sense. Yet it has a direct and measurable impact on performance, resilience, and long-term viability.

This is capability debt.

What Capability Debt Actually Is

Capability debt develops when an organisation’s ability to operate, adapt, and improve fails to keep pace with the complexity of its environment. Over time, gaps emerge between what the organisation needs to be capable of and what it can realistically deliver without excessive risk, effort, or dependency.

It becomes visible when critical knowledge is concentrated in a small number of individuals, when processes function primarily through informal workarounds, when systems are poorly understood by those who depend on them, and when automation or AI is layered on top of fragile workflows. It is also evident when major change initiatives deliver new tools without building the skills required to govern, maintain, and evolve them.

On the surface, the organisation may appear functional. Projects are delivered, services continue, and customers are largely unaffected. Beneath that surface, however, operational resilience is increasingly dependent on individual heroics, institutional memory, and external support.

That structural fragility is capability debt.

How Capability Debt Accumulates

Capability debt does not result from negligence. It accumulates through a series of rational, well-intentioned decisions made under pressure.

Leaders prioritise speed over knowledge transfer in order to meet deadlines. Core functions are outsourced without parallel capability development. Systems are implemented without establishing strong internal ownership. Training is deferred to preserve short-term delivery capacity. Change programmes focus on outputs rather than long-term competence. Firefighting behaviour is rewarded because it delivers visible results.

Each decision is defensible in isolation. Over time, however, they compound into systemic weakness.

Why Digital and AI Acceleration Intensifies the Risk

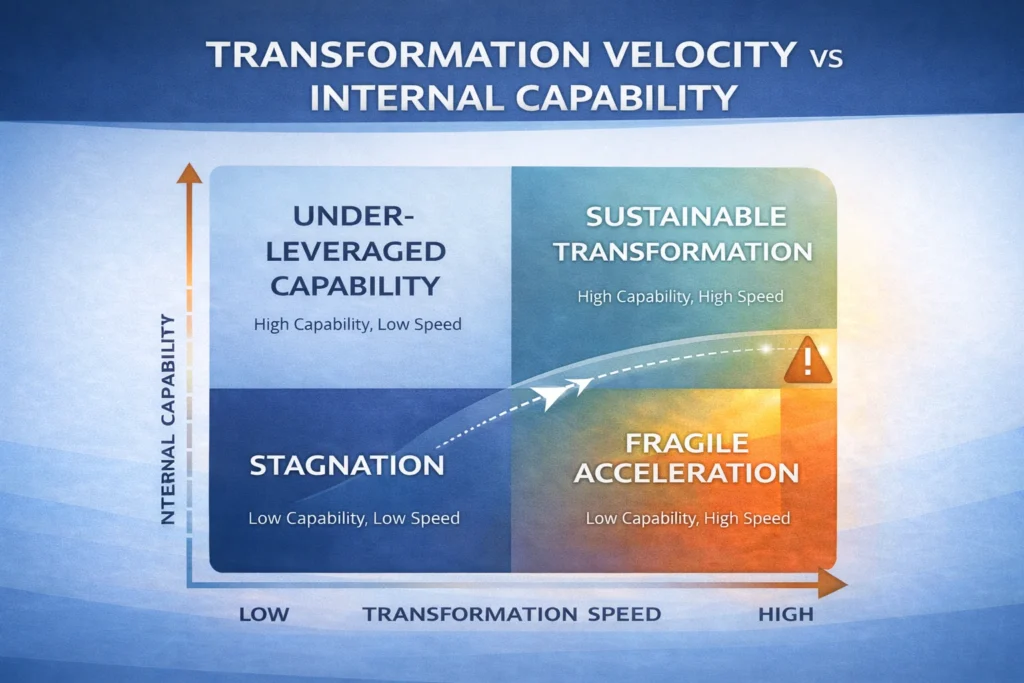

Digital transformation and AI adoption significantly amplify capability debt.

Modern platforms, automation tools, and AI systems increase organisational dependence on technical literacy, governance structures, and integration capability. When organisations adopt these technologies without investing in internal understanding and ownership, they increase operational risk rather than reduce it.

In the short term, productivity may improve. In the medium term, dependency grows. In the long term, resilience declines.

These organisations often become faster but more brittle. They can deliver more until something breaks. When failure occurs, recovery is slow, costly, and disruptive because internal capability to diagnose and resolve problems is limited.

The Hidden Costs of Capability Debt

Capability debt manifests in patterns that are frequently misinterpreted.

Organisations experience repeated transformation programmes that fail to embed change. They develop heavy reliance on consultants and vendors. Delivery timelines become unreliable. System adoption remains low. Key individuals experience sustained burnout. Good practice fails to scale. Risk visibility deteriorates.

These are not independent issues. They are symptoms of underlying structural weakness.

The Capability Debt Trajectory

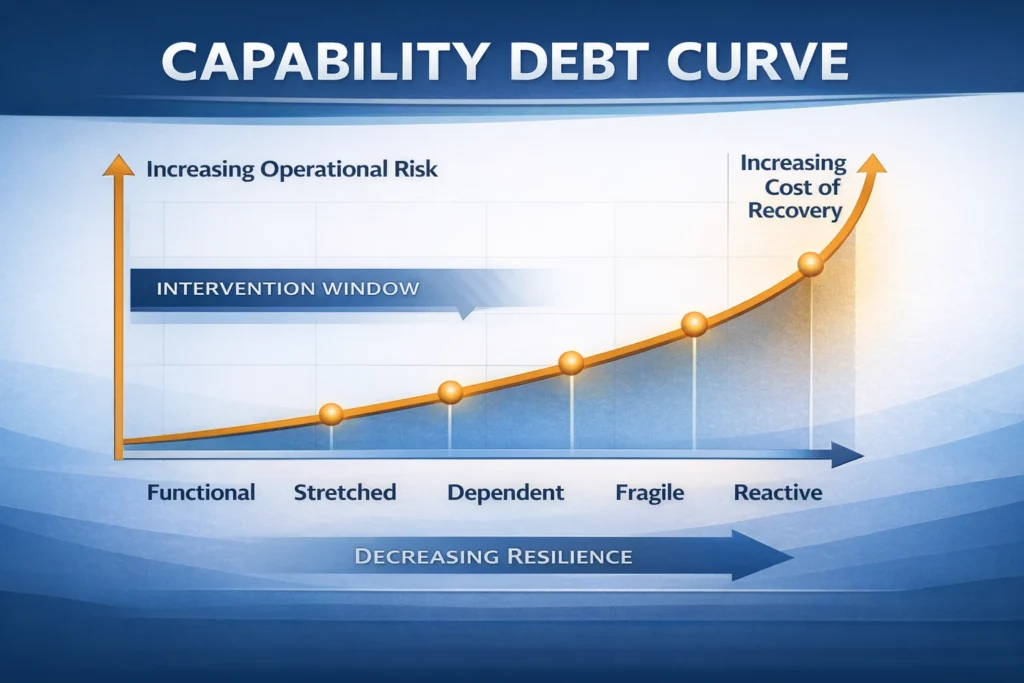

Most organisations follow a broadly predictable trajectory.

Initially, processes are well understood and knowledge is shared. As complexity grows, informal practices replace formal capability development. Over time, dependency on specific individuals and external providers increases. Eventually, the organisation becomes fragile, with small failures triggering disproportionate disruption. In advanced stages, most effort is consumed by maintaining basic operations.

By the time fragility is visible, recovery is already expensive. When organisations reach a reactive state, the cost of rebuilding capability can threaten viability.

Measuring Capability Debt

Capability debt cannot be managed without measurement.

It can be assessed across four core dimensions.

First, knowledge distribution: the extent to which critical processes depend on a small number of individuals.

Second, process ownership: the degree to which workflows have accountable owners who actively improve them.

Third, system literacy: how well teams understand the tools they rely on.

Fourth, change absorption capacity: how much transformation the organisation can absorb without destabilisation.

Weakness across these dimensions indicates rising debt.

Paying Down Capability Debt

Reducing capability debt requires deliberate, sustained investment in organisational foundations.

This is not achieved through additional tools, increased consulting spend, or larger transformation programmes. It is achieved through building durable internal capability.

This includes designing processes that can be understood and maintained internally, embedding learning into delivery work, creating explicit ownership for systems and data, treating AI governance as a core operational capability, rewarding knowledge sharing, documenting decision rationales, and conducting regular capability reviews alongside financial reviews.

These investments slow short-term delivery. They materially reduce long-term risk.

Why Capability Debt Is a Leadership Issue

Capability debt reflects leadership priorities.

When speed is consistently favoured over sustainability, when delivery is valued more than development, and when outputs are prioritised over ownership, capability debt increases.

Strong organisations do not eliminate debt entirely. They manage it consciously. They understand where it exists, what it costs, and how it is being reduced over time.

The Changeable Perspective

At Changeable, we see capability debt as one of the most significant unmanaged risks in contemporary organisations, particularly those accelerating digital and AI programmes.

Technology adoption is inevitable. The differentiator is whether organisations develop the capability to operate these systems responsibly, adaptively, and sustainably.

Technology scales existing conditions. This includes existing weaknesses.

Organisations that invest early in internal capability build resilience, adaptability, and long-term advantage. Those that ignore it accumulate risk quietly, until the cost becomes unavoidable.